IFIC proposes enhanced disclosure for investors

The investment funds industry is ready for more robust fee disclosure

Following the successful rollout of Client Relationship Model – Phase 2 (“CRM2”), the Investment Funds Institute of Canada (“IFIC”) believes that the fee transparency conversation is ready to advance further. In April 2017, IFIC advised Canadian regulators that it’s time for the industry to take the next step and offer broader transparency on Management Expense Ratios (“MERs”).

Let’s take a quick look back at the long history of CRM and the costs that make up MERs.

The history of CRM

CRM is a series of industry initiatives focused on improving the transparency between investors and the financial services industry.

It’s been almost 10 years since CRM1 came into force. CRM1 created harmonized registration requirements across the industry and also obliged firms to standardize disclosure of core information that affected the client-advisor relationship including (but not limited to):

- Types of products sold

- How suitability is determined

- Dealer obligations

- Investor responsibilities

- Compensation

- Conflicts of interest

These important pieces of information form the Relationship Disclosure Document.

CRM2 has been rolling out over the past four years and included the development of new personalized annual reports for investors that provide detailed information about the fees they pay and how their investments have performed. The new reports are:

- “Report of charges and other compensation” – details the charges and fees that investors have paid their advisor/firm directly or indirectly, in dollars and cents (not as a percentage)

- “Report on investment performance” – provides the investors’ personal rate of return over specific periods of time

MERs

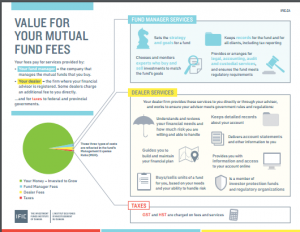

MERs are the fees charged by the manufacturers of investment funds to cover expenses of managing a fund. Typically, a portion of that fee is given to dealers/advisors for the professional advice and service they provide their clients. Click on the picture to view an infographic of how the MER is allocated.

With CRM2, the dealer/advisor compensation is disclosed on the new cost report. IFIC believes that disclosing the full MER, in dollars and cents, will provide further transparency and clarification. If the industry wants investors to truly understand the amount of fees that they pay for investing in funds, enhanced disclosure is the appropriate next step to take.

For more information about CRM, take our continuing education course on Client Relationship Model – Phase 2.

Resources:

https://www.ific.ca/en/news/investment-funds-industry-ready-to-tackle-crm3/