Time weighted vs. money weighted returns

How does one weigh returns?

Recent regulatory changes are going to dramatically impact how individuals view their investment returns. Learn what you need to know and when you need to know it.

By the time you read this message, the rollout of Client Relationship Model 2 (CRM2), one of the most important regulatory mandates introduced to the world of Canadian investment funds in recent history, will be completed and will have vastly changed the information investors receive concerning their investment fund holdings.

One of the most significant changes stemming from CRM2 is how investors will see the returns their fund holdings have generated on their client statements. It’s important that everyone – including all investment fund investors and industry professionals – understand this change to performance reporting that will show up on client statements beginning in January 2017.

Out with the old…

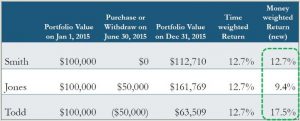

Before the final phase of CRM2 was introduced, investors of mutual funds would be provided with time-weighted rates of return. This type of return doesn’t take into account how much you have invested – meaning inflows and outflows of cash into and out of your funds. The time-weighted rate of return is generally considered a good indicator of a fund manager’s performance versus their benchmark. The downside of a time-weighted rate of return is it doesn’t give an individual investor a good idea of the actual rate of return they have achieved on their financial investment based on their investments and withdrawals.

…And in with the new

A money-weighted rate of return will now be provided in investor statements, as industry regulators believe this type of calculation is more relevant to individual investors. Instead of simply taking the total performance of a fund over a period of time into consideration, this type of investment return will also take all deposits and withdrawals into consideration when calculating your total rate of return. The difference between an investor’s time-weighted return and money-weighted return will be most significant when there have been large inflows and/or outflows of cash in or out of the fund during periods in which the fund’s performance is swinging wildly. Conversely, if there are no cash flows into a mutual fund in any given year, your time-weighted and money-weighted rates of return will be identical.

Example of time-weighted vs money-weighted returns in action

To learn more, please visit: http://www.osc.gov.on.ca/en/Dealers_crm2-faq-planning-tips.html

Other sources:

http://www.moneysense.ca/invest/calculating-your-portfolios-rate-of-return/,

http://www.mymoneyblog.com/personal-rates-of-return-money-weighted-vs-time-weighted.html

Next up: Know Your Client – What is changing about this rule?