Working with an advisor increases success

Working with an advisor helps investors reach their financial goals

Many advisors enter their profession because they know they can make a meaningful impact on the lives of clients and their clients’ family members. Advisors gain satisfaction from helping clients achieve their financial objectives, such as buying a home, paying for a child’s education, saving for retirement or any number of worthwhile goals.

Although everyone has financial goals, not everyone knows how to reach them. One of the best first steps an investor can take is to seek the help of a professional financial advisor. An advisor is specially trained and has the required expertise to put – and keep – their clients on the right track.

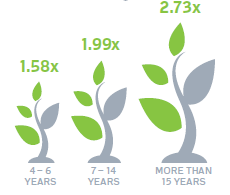

Before we look at some of the many ways that financial advisors help investors, the illustration below effectively sums up why it’s important to seek professional advice: history has shown that people who work with an advisor have increased their wealth. The longer people are advised, the larger their investments grow.1 That’s just one example of how you, as an advisor, can make a significant impact on your clients.

1 New Evidence on the Value of Financial Advice, IFIC 2012

10 ways that financial advisors provide immense value

As an advisor, you can help your clients:

- Create and maintain a comprehensive financial plan to help them establish and organize their goals

- Remain disciplined, even when markets are highly volatile, so they can stick to their long-term plan

- Adjust their plan whenever significant life circumstances (e.g., marriage, children, job loss, inheritance) occur

- Invest in products and solutions that are suitable for their time horizon, risk tolerance and financial goals

- Manage risk in their investment portfolio, while still seeking returns that will help them attain their goals

- Stay apprised of what’s happening in the financial markets, so they can be an informed investor with a healthy perspective on why their portfolio may move higher or lower in the short term

- Save regularly, and save more money, as part of a disciplined approach to financial management

- Invest in a tax-efficient manner so they can keep more of their money working for them

- Make use of tax-advantaged savings and investment vehicles like registered retirement savings plans (RRSPs), tax-free savings accounts (TFSAs), registered education savings plans (RESPs) and more

- Get in touch with another professional, such as a tax and estate planner, accountant or lawyer, so they can benefit from the expertise of others to address specific needs

For more important statistics about mutual funds and the value of financial advice, refer to IFIC’s infographic.